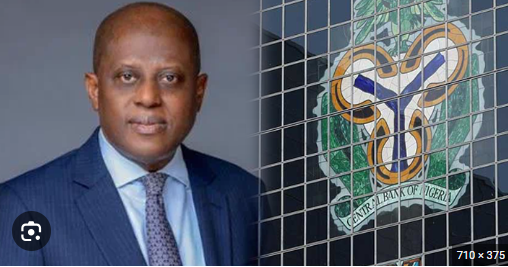

In a recent revelation, Governor Olayemi Cardoso of the Central Bank of Nigeria disclosed that a meticulous forensic audit, conducted by Deloitte, has exposed irregularities amounting to $2.4 billion in a $7 billion backlog of overdue foreign exchange transactions. These discrepancies range from missing documentation to unauthorized foreign exchange allocations to non-existent entities and beneficiaries.

Speaking on Arise TV, Cardoso emphasized the urgency in addressing the issues uncovered, as Africa's largest economy grapples with severe dollar shortages, leading to historic lows for the naira currency. The audit aimed to identify and rectify invalid transactions contributing to the naira's decline.

"We discovered that of the roughly $7 billion, about $2.4 billion had issues," Cardoso stated, underscoring the central bank's commitment to not honoring non-compliant transactions. Despite challenges, progress has been made, with $2.5 billion already settled across various sectors, including aviation, manufacturing, and energy.

Cardoso expressed confidence in resolving the remaining $2.2 billion swiftly, highlighting a positive outlook for overcoming the financial challenges faced by the country. He noted that the recent measures, such as limiting banks' foreign currency holdings and encouraging liquidity, aim to stabilize the situation.

In response to the economic crisis, the central bank has shifted focus to the supply side of the chain, taking aggressive steps to ensure liquidity and fostering contingency funding arrangements among financial institutions. Under Cardoso's leadership, the central bank is committed to implementing a more conventional monetary policy, aiming to reduce inflation from its December high of 28.92% to 21%. The governor expressed optimism, stating, "We'll clear everything soon and move on."